Insurance Companies help consumers to manage risk and to do this they traditionally built risk models to help them categorise their customers into risk categories. This was based on criteria like how likely someone was to make a claim and is the person who wants to take out a policy a bigger or smaller risk than the ‘average’ policyholder (for example, a young person with a high-powered car may be charged a higher premium as they are statistically more likely to be involved in an accident than a mature, experienced driver)?

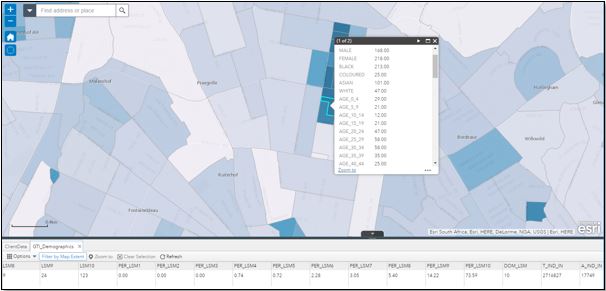

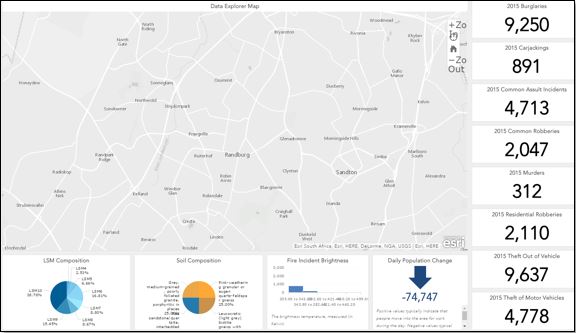

In more recent times, it has become more important for insurers to use the location of the customer in relation to the natural geographic data (geology, weather – hail, lightening, climate changes, fire patterns, etc.) and social aspects (crime levels per suburb, census, informal settlements, gated estates, etc.) and using this information as part of the risk models as well as to advise customers so that claims can be minimised (pre-emptive warnings of threat of hail, lightning storms, etc.). Insurance companies are now making use of GIS based applications to determine certain risks in the business and to geocode their client information. This put a major overhead on insurers to skill up GIS operators, purchase GIS servers and manage GIS data.

Esri South Africa has since built a hosted solution on ArcGIS Online (AGOL) which addressed key problem areas at a fraction of the price; a solution with similar capabilities to the hosted solution would usually cost hundreds of thousands or even millions of Rand’s and would still not be as flexible. By using this affordable low risk hosted solutions from Esri, the customer can sell the concept and advantages of GIS in the business by demonstrating the results internally, using their own business information.

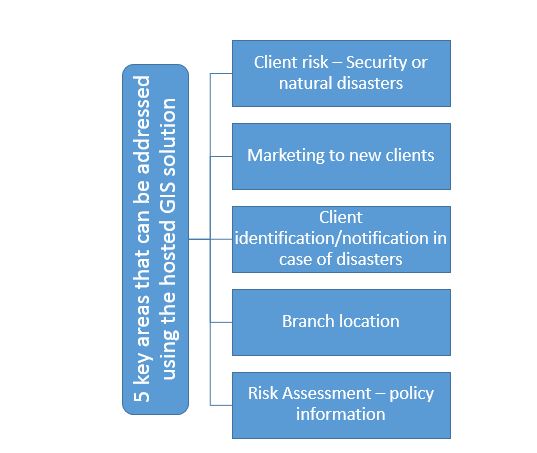

This was done in collaboration with a South African based insurer whose business problem came down to 5 key areas: client risk segmentation; finding new clients; client notification; branch location; risk assessment

- The insurer does not know where they clients are in relation to the possible risk involved with insuring the client.

- The client is looking to find new clients and are using the shotgun approach which is not very profitable.

- The insurance company want send the relevant clients notifications when a natural disaster will affect the client.

- The insurance company wants to place new branches in the correct location for maximum exposure.

- The client wants to understand where they are exposed when natural disaster puts them at risk for specific items in a client policy, like expensive cars etc.

Esri SA’s approach has been to rapidly deploy tools to address these problems, by leveraging the ArcGIS Platform; this is enabled by web application to address all the key problems. The outcome was specific applications which could be used in a simple and effective manor by various departments within the insurance company.

Using this approach, Esri SA has been able to create value for our clients by addressing the key challenges and because of the success of this solution we can also identify problems this customer did not know about.

The next steps will be to assist the client with data quality and to implement a process to ensure data integrity

From there we will focus on perfecting risk profiles and pricing models for existing and new clients.

As we grow the capabilities the users within the organization should also increase with the goal of a centralized view of the business for all the departments.